Invest in your Lifestyle

Explore the fascinating world of alternative assets

What We Do

Explore the world of alternative assets

Our clients typically have worked very hard for their financial achievements in life. However, here at Spice Lifestyle we are here to remind you that you need a balance in your busy lives. As mental health has come more into focus in recent years, we recognise it’s vitally important you put down the pen (or keyboard) and have some downtime.

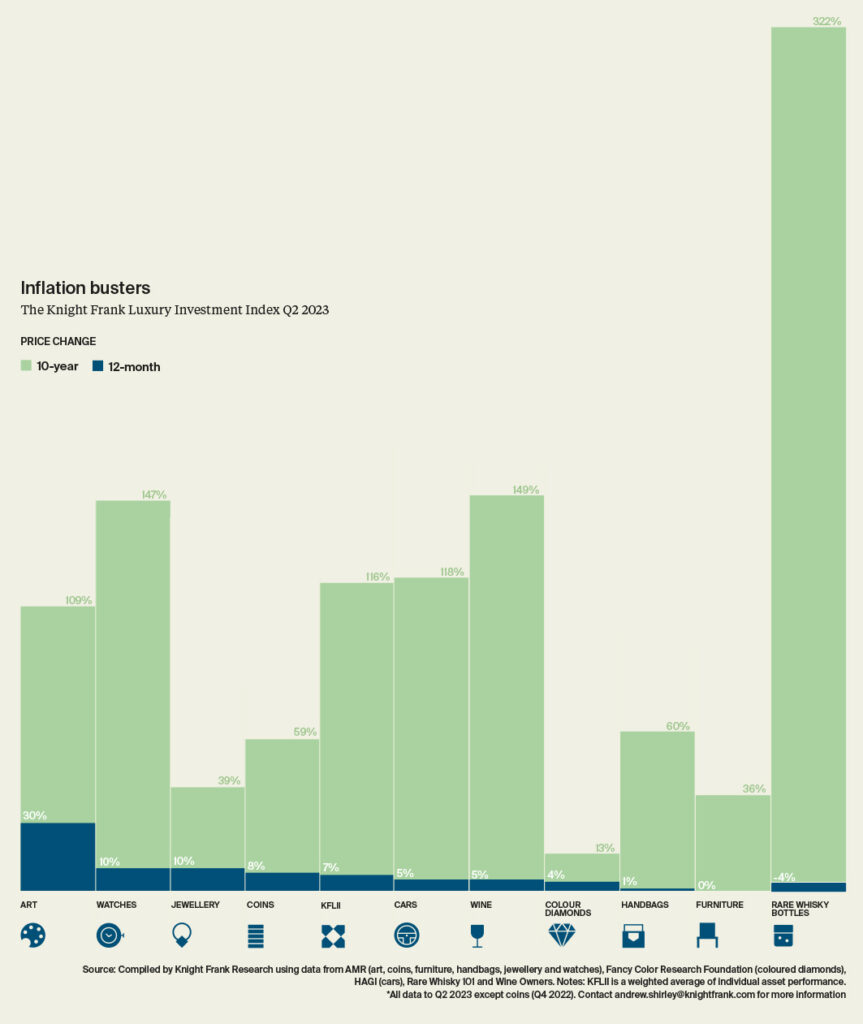

However, downtime does not mean wasting time or money on frivolous activities (not always anyway) so here at Spice Lifestyle we decided to assist our clients to have fun and at the same time to explore some potential investment avenues. We plan to explore the so-called alternative asset classes and combine this with some fun and absolutely no-obligation opportunities. Alternative asset classes we are initially considering include, but are not limited to:

- investment-grade wine

- classic and vintage cars

- rare whisky

- stamps and coins

- art

- watches

- holiday homes

- early stage start-ups; and

- other collectables

We will explore a variety of lifestyle passions and understand how to make money at the same time!

One of the key advantages of working with the Spice group is that we are not tied to any wealth manager or banker who is fixated on increasing his or her assets under management (AUM). Alternative assets such as these do not count as AUM so your banker/ financial planner has no interest in them although here at Spice Capital , we consider alternative assets as another very highly rewarding asset class, providing both tanglible and intangible enjoyment.

Fine Wine

Investing in wine has never been more lucrative. Top quality wine even has its own exchange, the London International Vintners Exchange which came online in 1999. Just like the Dow Jones or the FTSE100 indices, you can follow the Liv-ex Fine Wine 100 Index, which follows the top 100 most sought-after wines!

So where to start? Anyone who has heard of wine knows that French wine is the must-have. Starting with French Bordeaux.

Classic and Vintage Cars

This is without doubt an asset class to continue to follow closely with the pending doomsday getting closer: the complete electrification of the car industry ! Scarcity has already driven prices higher and predictably will do so even more as the internal combustion engine will soon be resigned to the history books.

But car-lovers and investors alike will still desire to possess, drive and dote on these petrol-powered pieces of history.

Rare Whisky

You may or may not like to drink the ‘water of life’ but the investment returns from rare whisky would whet your appetite! Over the past decade we have seen returns of around 500%. The options for investing in whisky have also matured, from buying and selling individual bottles and casks to investing in whisky funds

If you are already a whisky fan, why not make your favourite tipple work for you!

Watches

Owning a luxury watch can fulfil a many and varied set of human needs including: It is an appreciating asset (since the 70’s the price of a stainless steel Rolex has never depreciated!); it’s portable; you can celebrate milestones with it; it’s an investment in your style/brand; and can be passed down from generation to generation.